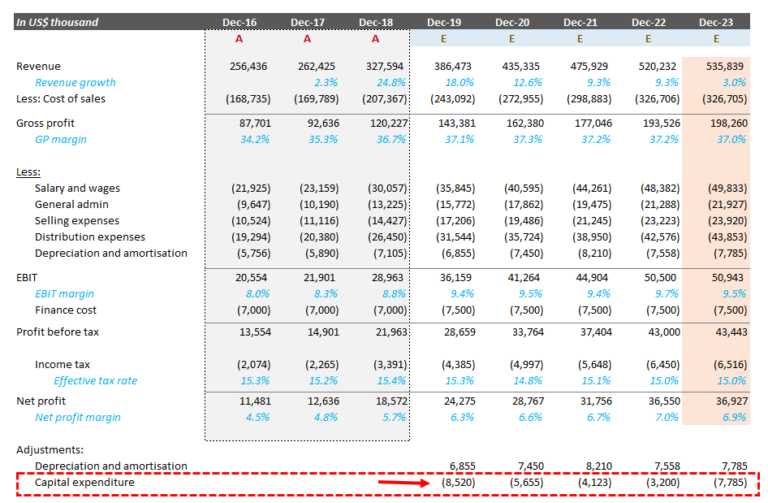

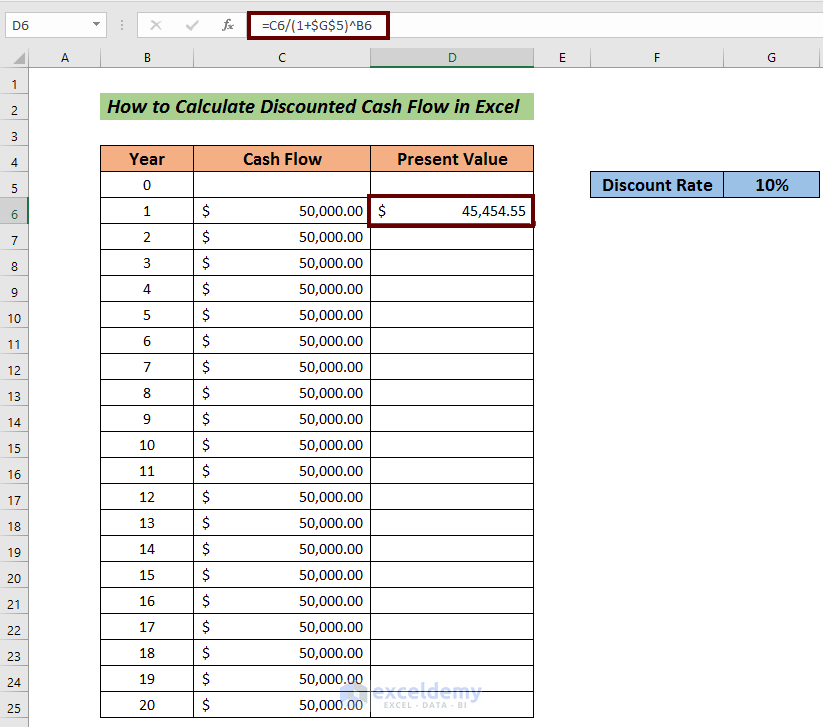

A higher growth rate means the discounted versions of your future cash flows will depreciate each year until they bottom out at zero. In this case, the growth rate (15%) is higher than your company’s cash flow (5%). This is based on the compounded rate of return (15% in this example) you think you can achieve with your money today. The DCF equation translates future cash flows into how much they’re valued to you today. In our example, your business’s present value would be worth $955,371 over a three-year period.

Now, let’s say you have a target compounded rate of return of 15% per year, which will represent “r” in the DCF formula. Now that your cash flow, you can begin calculating the company's value with the DCF formula. However, for this example, we’ll stick to forecasting three years in advance. To calculate CF3, you will then find 5% of $420,000, which is $441,000.ĭepending on how far you want to forecast, you can continue repeating the cash flow calculation. You’ll then add $20,000 to $400,000 to get $420,000, which is your cash flow (CF2) for the next year. To calculate your cash flow (CF), you’ll multiply $400,000 by 0.05 to get 5% of $400,000, which gives you $20,000.

#Calculating discounted cash flow free

You find that the business brings in $400,000 each year in free cash flows and has a steady rate of 5% each year. Let’s say you look at your business’s balance sheet.

Now that we know the DCF formula, let’s put it into practice with a hypothetical example. This is because getting a reliable Quote of how a business will perform that far in advance can be difficult. It’s used to forecast the perpetual growth rate, typically beyond five years in the future. Terminal value: the terminal value measures the future value of a business at the end of the projection period in the DCF analysis. Projected cash flow is the amount of money expected to come in and out of your business during a specific period of time. Projected cash flow: in the DCF formula, “CF” refers to the expected cash flow for the given year. Periods of time: in the DCF formula, “n” refers to the period of time, expressed as years, quarters, months, or any other time period. It’s common to use the WACC, the rate a business pays to finance its assets. The discount rate is the cost of capital for a business, which is similar to an interest rate on future cash inflows. The discounted cash flow analysis uses these elements to help predict how much an asset is worth today:ĭiscount rate: in the discounted cash flow formula, “r” refers to the discount rate. To calculate DCF, we need to consider certain factors. Private equity firms use the discounted cash flow method to form financial models, by determining the expected and forecasted cash flow of a business, to use as decision-making tools for investing. This concept shows how cash available to a company today is worth more than the same amount in the future.īy knowing how much an investment is worth, business owners can decide whether to stick with it or walk away. This calculation describes the time value of money. Businesses can then use it to compare to other investments to see which one will provide the biggest benefit. In other words, DCF analysis looks at how much money investment will make over time. One cash flow measurement we’ll discuss in this article is the discounted cash flow method.ĭiscounted cash flow (DCF) is a valuation method that businesses use to estimate how much an asset is worth in the long term by using future cash flows. There are several ways to measure cash flow, such as the free cash flow (FCF), cash flow from operating activities (CFO), and levered cash flow (LCF) methods. Cash flow represents how much money goes in and out of a business’s doors.

0 kommentar(er)

0 kommentar(er)